Peterborough Blogs

Voice of Business: Direct Access to Government is a Key Part of Advocacy

/More than 100 local business and community leaders gathered at Market Hall last week for a chance to discuss business issues with Minister Anita Anand, President of the Treasury Board of Canada.

It was an opportunity to raise concerns and address pressing issues to someone in the inner circle on Parliament Hill, a discussion that hopefully leads to stronger public policy.

The Peterborough and the Kawarthas Chamber of Commerce as well as our colleagues at the Ontario and Canadian Chambers of Commerce regularly meet with and voice our concerns to our elected leaders, but it’s important that we aren’t the only voices they hear from. While we do our research to understand a variety of issues — we don’t know it like those who work with it day in and day out.

As chambers, we can appreciate that the best solutions come at the grassroots level from local business, non-profits, charities, and community-minded people. Our own policy and advocacy process is built on grassroots advocacy. We take local discussions and issues raised by businesses and organizations and turn that into advocacy policy that we then bring to the provincial and national levels. It’s a direct pipeline to our elected leaders.

But the chamber advocacy process is just one part. We strive to provide opportunities for local business and community leaders to directly talk with their government leaders. Events like the discussion with Minister Anand allow the decision makers to hear the concerns and creative solutions directly from those experiencing them. Opportunities like this are a key part of the Chamber’s role in the community.

We have plans for quite a few upcoming opportunities. Power Hour, a signature annual Chamber event, is returning on Friday, February 23. This event features a discussion with the Warden of the County of Peterborough, the Mayor of the City of Peterborough, our provincial Member of Parliament, and our federal Member of Parliament. Attendees can submit questions ahead of time or write them down during the event.

In 2024, we are planning events with as many of our local elected leaders as we can, including a Warden’s breakfast scheduled for April 19 and another breakfast with several township mayors planned for June.

On top of these public events, we hold regular roundtable discussions. These events are typically a smaller group of 10 – 20 businesses and organizations with interest in a particular topic. We have a few coming up in the next couple weeks, including one on skilled trades and another on Employment Insurance. Our aim is to keep the groups small enough to be able to have a meaningful and candid conversation with the government representatives on hand. To do this, we do have to limit numbers and offer space by invitation-only. If you’re a Chamber member interested in being part of these conversations, let me know.

In addition to discussions directly with government representatives, we work with chambers across Canada where businesses are dealing with similar issues to work together on our efforts for change.

Together, we have a stronger voice in addressing the issues and opportunities that will help our communities thrive.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

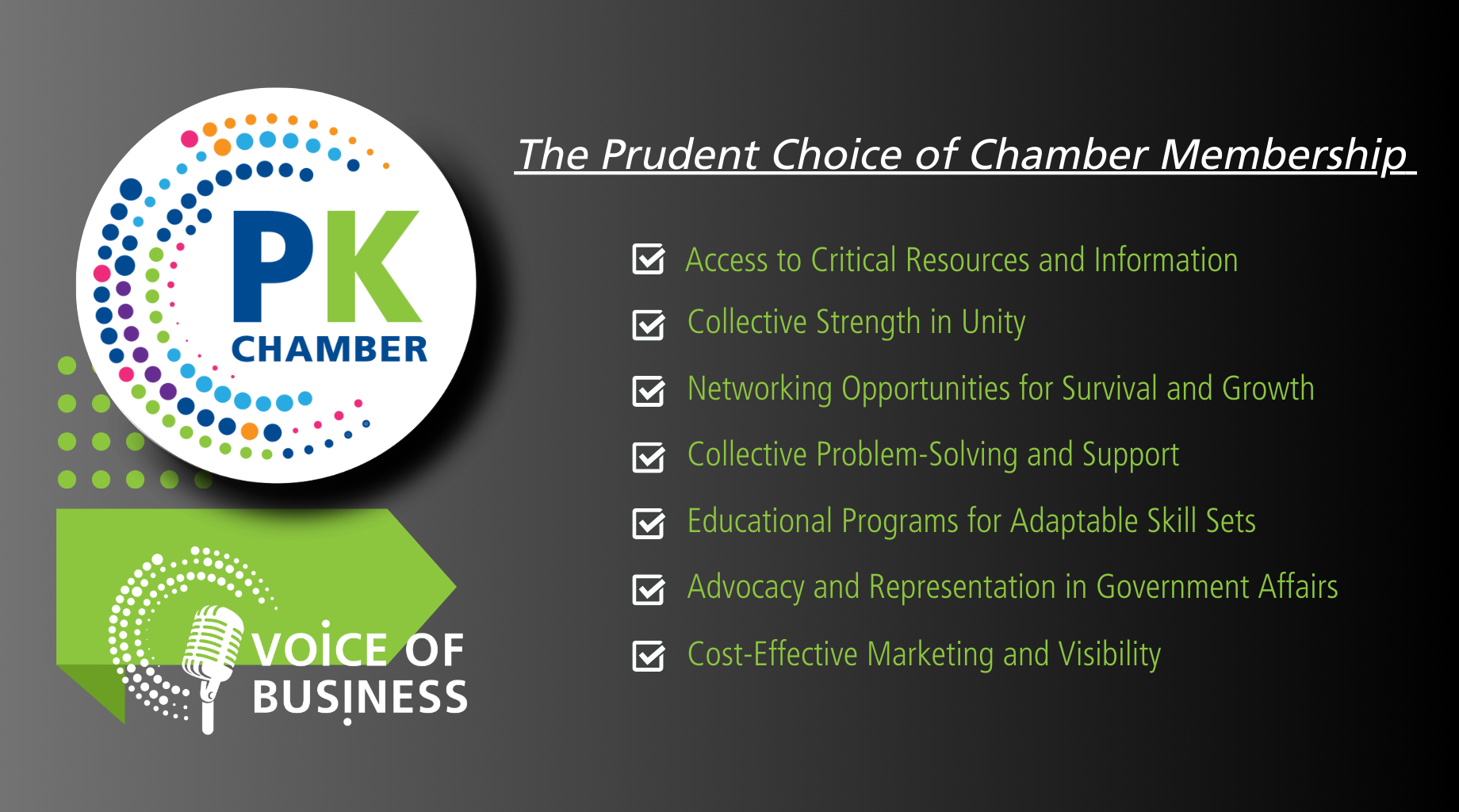

Voice of Business: Navigating Economic Uncertainty: The Prudent Choice of Chamber Membership

/Guest Column by Olivia Farr, Communications Specialist, Peterborough and the Kawarthas Chamber of Commerce.

In times of economic uncertainty, businesses often find themselves at a crossroads, grappling with tough decisions to safeguard their interests and maintain stability.

One strategic move that stands out as a beacon of support and resilience is joining your local chamber of commerce. This age-old institution has proven to be a valuable ally for businesses during periods of economic turbulence. In this article, we will explore why Chamber membership makes profound sense in the face of uncertainty.

1. Collective Strength in Unity

Economic uncertainty tends to breed challenges that no single business can face alone. By joining a chamber, businesses become part of a unified front, collectively navigating the storm. Chambers of commerce serve as powerful advocates for their members, leveraging their collective influence to shape policies that favour local businesses and stimulate economic growth. This unity allows businesses to pool resources, share insights, and face challenges with a stronger, more resilient approach.

2. Access to Critical Resources and Information

In periods where the economy is shifting, information becomes a priceless asset. The Chamber plays a crucial role in publishing timely and relevant information to their members through formats much like this Voice of Business blog. From legislative changes and market trends to funding opportunities and industry insights posted on our Resource Hub, chambers keep their members informed, helping them make well-informed decisions. This access to critical resources empowers businesses to adapt swiftly to changing circumstances and stay ahead of the curve.

3. Networking Opportunities for Survival and Growth

In times of budgetary anxiety, the importance of networking cannot be overstated. Chambers provide a structured platform for businesses to connect, collaborate, and forge partnerships. The PK Chamber hosts a minimum of three monthly networking events and several annual events. These networking opportunities can be a lifeline for businesses looking to weather the storm.

Chamber networking enhances your job-related support in two key ways—facilitating both job seekers and employers. For those seeking employment, the network offers a valuable avenue to discover opportunities in the concealed job market before they become publicly available.

On the flip side, for employers seeking to fill positions, engaging with peers in similar roles through the chamber can contribute to crafting comprehensive job descriptions. This collaborative approach ensures a more robust hiring process, fostering a better fit for your organization. This interconnectedness exemplifies the crucial role of networking, a lifeline for businesses navigating economic uncertainty. Chambers of Commerce provide the structured platform needed to establish these vital connections, enabling businesses to share resources, explore new markets, and devise innovative solutions to shared challenges.

4. Advocacy and Representation in Government Affairs

Economic uncertainty often coincides with shifts in government policies and regulations. Navigating this complex landscape requires a united voice to advocate for the interests of businesses. Your chamber actively engages in government affairs, representing their members' concerns and advocating for policies

that promote economic stability and growth. Being part of a chamber ensures that your business has a seat at the table when crucial decisions are being made that could impact business operations.

5. Educational Programs for Adaptable Skill Sets

The ability to adapt to shifting economic positions is a key determinant of success. The Chamber frequently offers educational programs, workshops, and seminars to equip our members with the skills needed to thrive in a rapidly changing business environment. From digital transformation to crisis management, these programs empower businesses with the knowledge and tools necessary to navigate uncertainty and emerge stronger on the other side.

6. Cost-Effective Marketing and Visibility

Maintaining a visible presence in the market is challenging during economic downturns when marketing budgets are often under scrutiny. Chamber membership provides businesses with cost-effective marketing opportunities, such as sponsorship of events, inclusion in business directories, and access to promotional channels like our newsletter and social media platforms. This increased visibility can be a lifeline for businesses seeking to maintain and expand their customer base despite economic headwinds.

7. Collective Problem-Solving and Support

Uncertain times can be isolating, with businesses feeling the weight of their challenges alone. Chamber membership fosters a sense of community and support, creating a space for businesses to share their struggles and successes. Collective problem-solving becomes a hallmark of chamber membership, as businesses work together to find innovative solutions and offer support to those facing particularly challenging circumstances.

Conclusion:

In today's state of the economy, businesses are confronted with the imperative to adapt or risk stagnation. Chamber membership emerges as a strategic move, offering a lifeline of support, resources, and collaboration. The collective strength, access to critical information, networking opportunities, advocacy in government affairs, educational programs, cost-effective marketing, and a supportive community all make chamber membership a wise investment in times of economic uncertainty. As businesses navigate uncharted waters, the chamber of commerce stands as a steadfast partner, guiding them through the storm and towards a more resilient and prosperous future.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: Heat Pump Explainer

/Guest Column by Rebecca Schillemat, Executive Officer of the Peterborough and the Kawarthas Home Builders Association

Heat pumps have gained substantial popularity across Canada due to their energy efficiency and versatility in providing heating and cooling solutions.

These systems utilize a reversible refrigeration cycle to extract heat from the air, ground, or water sources, transferring it indoors during winter for heating and expelling it outside during summer for cooling. This article is about Air Source Heat Pumps (to be referred to as heat pumps). There are also geothermal or ground-source heat pumps available in Canada.

Heat pump technology was first demonstrated in 1748, and the first heat pump was built in 1857.1 Modern heat pumps can heat comfortably in a home with minimal air leakage when the outside temperature is as low as -20 °C. Heat pumps are energy efficient, with the definition of energy efficiency being to use less energy to get the same task done. Natural gas is 98% efficient at heating a space,2 while heat pumps can be 300-500% efficient because they are designed to put out more energy than they take in to run the system.

The Government of Canada has been researching energy efficiency home building and renovations options across Canada through the department of Natural Resources Canada (NRCan) in partnership with the Canadian Home Builders Association (CHBA).3 Together, NRCan & CHBA have been researching Net Zero Home Building for over a decade, including using heat pumps.4 The case studies from across Canada inform guidelines for energy-efficient building.5 The 2020 National Building Code is a 5-tier system, each being more energy efficient. Tier 5 is beyond a Net Zero Home, with Net Zero defined as homes that produce as much clean energy as they consume annually, using on-site renewable energy systems.

A heat pump costs anywhere from $5,000 to 15,000 to purchase and install. Enbridge is offering up to $4,500 for the Clean Home Heating Initiative, and the Canadian Government is offering up to $5,000 with the Greener Homes Grant to install heat pumps in residential homes.

Since heat pumps work by taking outside air and transferring that energy to the inside air, having a leaky home greatly reduces heating efficiency for all heating/cooling systems. The first step in determining how efficient a heat pump is for your home is getting an energy audit by a certified energy advisor, including a blower door test. New homes with an Energy Star Rating have 2.5 Air Changes per hour (ACH), Net Zero homes are 1.5 ACH and the Passive House standard is 0.6 ACH. The air tightness requirement in the National Building Code dovetails to achieve maximum energy efficiency with a heat pump.

Overall, heat pumps offer an efficient and environmentally friendly solution for heating and cooling in Canadian climates. Their ability to reduce energy consumption and greenhouse gas emissions makes

them a compelling choice for residential buildings despite some limitations related to extreme weather conditions and upfront costs. Heat pumps with a backup heating method are an excellent first step in renovating existing homes to be more energy efficient. Heat pumps are an excellent option for new homes to maximize the energy efficiency of new home construction.

The Peterborough and the Kawarthas Home Builders Association (PKHBA) is the voice of the residential construction industry in Peterborough City & County and City of Kawartha Lakes. PKHBA represents over 100 member companies including builders, developers, professional renovators, trade contractors and many others within the residential construction sector. PKHBA had the opportunity to host two education sessions through CHBA’s Local Energy Efficiency Partnerships (LEEP) Program in fall 2023 in Peterborough; one on Mechanical & HVAC systems, including heat pumps and one on the Building Envelope, including windows and insulation.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: Transitioning Medium- and Heavy-Duty to Net-Zero

/Reaching our net zero emissions goals will require de-carbonizing as many areas of greenhouse gas emissions as possible – including vehicle fleets.

Transitioning medium and heavy-duty vehicles away from fossil fuels will be particularly challenging. There’s a new policy primer from the Ontario Chamber of Commerce titled Transitioning to Low-Carbon Fleets in Ontario, which provides some insights in what it will take to make the move.

According to the report, emissions from freight transportation in Canada have increased more than 250 per cent from 1990 to 2019.

Technology options include turning to electric or plug-in hybrid electric vehicles to reduce tailpipe emissions. There is potential that hydrogen fuel cells could be used for emission-free long-haul deliveries. Another area of development is around clean fuels, including renewable natural gas and diesel.

The OCC breaks down its recommendations into four categories:

Clean energy supply

Going electric is going to require significant investments in clean baseload power. Right now, 75 per cent of power generation in Ontario comes from nuclear and hydroelectric and we will need more overall power output to meet growing demand.

Recommendations:

Prioritize procurement and financing of clean baseload electricity infrastructure projects.

Work towards a more flexible and streamlined regulatory framework for clean energy projects. For example, environmental and safety assessments approved by one level of government should be able to form the basis for approval by another government and for the expansion or continued operation of those sites.

Set supply targets and incentivize production of hydrogen, RNG, and renewable diesel, borrowing best practices from British Columbia’s Low-Carbon Fuel Standard.

Charging and refueling

Charging and refueling continue to be big barriers to clean tech adoption. While we have made significant progress in adding more charging stations, most of that is focused on consumer vehicles and are not suitable for medium and heavy-duty fleet operators.

Recommendations:

Expand and incentivize investments in charging and refueling station infrastructure for low-carbon commercial fleets across major supply chain and commercial transportation routes.

Expand electricity distribution infrastructure across the province to support the added charging infrastructure.

Implement an alternative electricity rate structure for commercial EV fleet operators to incentivize time-of-use behaviours and reduce cost barriers.

Work with industry and post-secondary institutions to ensure Ontario’s workforce has the skills needed to build and operate low-carbon transportation infrastructure.

Clean technologies for medium- and heavy-duty vehicle classes

The electric vehicle market is developing quickly, but alternatives that may be better suited for medium and heavy-duty vehicles need investment. These include hydrogen and renewable natural gas vehicles.

Recommendations:

Invest in low-carbon vehicle research and development programs at Ontario’s post-secondary institutions to support the advancement and commercialization of new technologies for medium- and heavy-duty vehicle classes.

Recognize RNG as a zero-emission technology solution.

Recognize the contribution of low-carbon intensity liquid fuels as part of the transition while low-carbon vehicle technologies advance.

Purchase incentives

The cost of purchasing low or zero-emissions fleet vehicles is a major barrier for businesses.

Recommendation:

Consider adopting a low-carbon vehicle incentive program for commercial fleets to complement the federal iMHZEV program and Green Freight Program, and match the incentives found in British Columbia and Quebec.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: Tax Ratio Increase a Hit to Local Manufacturing; Guest Column From Tim Barrie

/Mayor Leal and Council,

In 2008, I was a part of a committee formed by the Kawartha Manufacturers Association and the Chamber of Commerce. We worked with the Council of the day to have them act on regulation 386/98 of the Municipal Act, 2001. The Provincial Government had brought in substantial changes to the municipal property taxes with current value assessment and revisions for tax fairness. It was found that municipalities overtaxed business properties relative to the services they received and that Industrial and Commercial rates should be at 85 per cent, and no more than 110 per cent of the residential rate.

Industry in Peterborough was paying 260 per cent of the residential rate in 2008 and Council committed to a 10-year journey to reach a 1.5 multiple milestone, with the intention to eventually get to parity with residential. Industrial tax rates reached that milestone two years ago.

The previous four Councils worked hard towards tax fairness in Peterborough. This Council is going backwards.

My company, Merit Precision, is a contract manufacturer of plastic, steel, and zirconium parts to a wide variety of industries over much of North America and Europe. We employ about 80 people in Peterborough.

Last year Merit paid $123,395 in property tax, or the profit on its first $2.47M in revenues.

Unlike Government, Merit is unable to raise prices to offset increased costs as pricing is set on the world stage. Unlike Government, Merit will have to reduce costs to maintain a realistic margin or go out of business.

The City of Peterborough does not have a tax revenue problem. It has a cost problem. I see nowhere in your deliberations that you have attempted to reduce your costs in any meaningful way. It is certainly appropriate to raise taxes to pay for capital improvements, but a 10 per cent increase for operations is outlandish.

If you do opt for the easy way out, please never again lament the lack of manufacturing jobs in this community.

Respectfully,

Tim Barrie

President, Merit Precision Ltd.

The Peterborough and the Kawarthas Chamber of Commerce has issued a letter to City Council and a media advisory regarding the tax ratio increase.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: Supporting Stronger Indigenous Economic Outcomes

/We need to do better when it comes to economic reconciliation.

Economic reconciliation is so much more than a moral imperative — the cost of inaction is holding us back culturally and economically.

There’s a new policy paper from the Ontario Chamber of Commerce (OCC) and Canadian Council for Aboriginal Business (CCAB) called Sharing Prosperity: An Introduction to Building Relationships for Economic Reconciliation in Ontario. It’s an introductory resource as part of the Economic Reconciliation Initiative, a partnership between both organizations aimed at advancing economic reconciliation by building business capacity to implement the Truth and Reconciliation Commission’s Call to Action 92.

It's key to appreciate that reports like this are a starting place. It provides some of the resources to build relationships and move us in the right direction. To get there, it helps give historical context, provides insights on Indigenous rights, highlights challenges facing Indigenous businesses, and provides meaningful opportunities for engagement.

The report describes an Indigenous economy that is both strong and growing with Indigenous businesses contributing nearly $50 billion annual to Canada’s GDP. There are more than 75,000 Indigenous-owned businesses and entrepreneurs in Canada.

Some of the key actions that businesses can take include:

Advancing Indigenous cultural awareness and education by sharing territorial acknowledgements, distributing educational reconciliation resources to staff, providing Indigenous cultural competency training, and attending/participating in Indigenous events.

Promoting equitable Indigenous employment and business opportunities by providing reduced rates/complimentary access to events, memberships, and training for Indigenous businesses/individuals, implementing inclusive Human Resource strategies to recruit and retain Indigenous candidates, auditing workplace policies and procedures to promote reconciliation, linking executive compensation to economic reconciliation performance metrics, and convening an Indigenous Advisory Committee.

Engaging with Indigenous communities and supporting economic development by making Indigenous community investments, developing Indigenous partnership-building and engagement strategies, implementing Indigenous procurement policies, obtaining certification/accreditation in Indigenous relations, developing a Reconciliation Action Plan, and entering into revenue- or equity-sharing agreements with Indigenous businesses and/or communities.

Diversity, equity and inclusion as well as environmental, social and governance goals are becoming a bigger priority for many businesses and organizations. While connected to both of those approaches, economic reconciliation puts a focus on efforts to recognize the unique, inherent, ancestral, and customary responsibilities of Indigenous Peoples.

Reports like Sharing Prosperity help outline what businesses and organizations of all sizes can do to support stronger Indigenous economic outcomes.

As stated by the OCC Board of Directors: “It is critical to underscore that reconciliation is not about ‘checking a box’ but rather committing to a continual process of learning and action.”

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: Businesses to Pick Up the $3 Million Tab For Appearance of Tax Savings

/Increasing the tax ratio for commercial and industrial properties does not save money, increase revenue, or reduce taxes — it merely shifts who pays more taxes.

Yet, this move is being touted by the City of Peterborough’s finance committee as savings as part of its strategy to get the all-inclusive tax rate increase down from 9.59 per cent to 7.38 per cent. The recommendation will increase the ratio of what commercial and industrial property owners pay from 1.5 times that of residential taxpayers to 1.65, shifting $3 million in taxation to local businesses.

What’s especially frustrating is that this decision appears to have been made on a whim – without consultation with the business community or connection to any particular economic plan. The original staff recommendation in the draft budget was to leave the tax ratio as-is.

Decisions around tax policy should have strategic goals and involve consultations. Fourteen years ago, the council of the day worked with industry associations and businesses themselves to come up with a strategy to increase economic growth in our community. The result was a target commercial and industrial tax ratio of 1.5. Getting there took a decade with gradual decreases in the ratio and included regular input from the business community. The result played a role in the rapid development of employment lands in the city to the point that we now have very few spaces for business to move and grow into.

Local businesses are already paying much higher taxes than residents and we aren’t pushing for anything besides the status quo, which is an established competitive benchmark.

Recognizing that businesses already pay 1.5 times the rate of residents, our recommendation is that the City work to expand our employment lands. We’ve been talking about this issue for the better part of 20 years with little progress and now we’re at a critical tipping point with local industry. I’ve talked with two local manufacturers in the last two weeks who are local success stories and are outgrowing their facilities. We have nowhere for them to expand to and we may lose them in the near future. We also have businesses interested in setting up in the region but we have no suitable properties to offer.

Let’s generate more tax revenue from the business community by expanding our commercial and industrial tax base! As an added bonus, businesses typically use fewer services than residents despite their higher tax rate. It’s a win-win for residents and the City.

Many in the business community are still struggling from a few very challenging years. It has been a tough go for many — businesses, residents, and even the municipality. Everything is getting more expensive. The reasons the City is facing a soaring budget increase — rising labour, fuel, and capital costs due to significant inflation — are the same struggles being faced by our local business community. Many businesses are also struggling to service significant debt incurred during the pandemic, which is now at much higher interest rates with repayment deadlines looming.

We applaud our elected leaders for recognizing that the proposed tax increase will be a significant burden for some in our community and are making efforts to reduce this. Many councils over the decades have faced tough decisions at budget time. There are many unpopular choices to make, which typically fall into two areas — increase taxes or reduce services. Everything proposed in the budget has value, but we elect our leaders to make the tough decisions when the time comes.

It’s an oft-repeated line from elected leaders that there is one taxpayer. Shifting $3 million in tax levy to one group of property owners and calling it savings for another does not give the impression that we are all in this together.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: OCC Calls For Forward Looking Investments in Budget 2024 Amidst Economic Challenges

/Guest Column from the Ontario Chamber of Commerce

In the wake of the Province’s Economic Outlook and Fiscal Review, Rocco Rossi, President and CEO, Ontario Chamber of Commerce (OCC), is calling on the Ontario government to prioritize strategic, long-term investments in the upcoming 2024 budget.

“Ontario’s business community continues to grapple with challenges ranging from labour shortages to inflation to broader economic uncertainty. In Budget 2024, the Ontario government needs to focus on measures that not only support immediate growth but also lay the groundwork for sustainable long-term economic expansion.”

The OCC’s membership encompasses a wide range of industries, each with its unique needs and challenges. However, there are crucial areas where the government’s focus in the 2024 budget can significantly impact all sectors. These include:

Investing in Workforce Development: To address critical labour shortages, investments to resolve skills mismatches are vital. These initiatives should be designed to close the gap between current workforce skills and the evolving demands of Ontario’s labour market.

Enhancing Infrastructure: Strategic investments in infrastructure, including transportation and digital connectivity, can boost immediate economic activity while supporting long-term growth. This includes expanding broadband access in rural and remote areas and upgrading public transit and road networks.

Fostering a Business-Friendly Environment: Implementing policies that reduce red tape and create a conducive environment for business growth is essential. This includes reviewing and streamlining regulatory processes, providing tax incentives for businesses looking to expand or relocate to Ontario and targeted support for indebted small businesses.

Supporting Innovation and Technology: Encouraging the adoption of new technologies and supporting innovation can help Ontario businesses remain competitive in a global market. This includes providing incentives for research and development and supporting technology-driven sectors.

“The OCC welcomes the Province’s commitments in its 2023 Ontario Economic Outlook and Fiscal Review across crucial policy areas, including housing, health care, investment attraction, workforce, and infrastructure, which will have positive implications for the economy. Notably, the new Ontario Infrastructure Bank (OIB) has the potential to unlock private investment in infrastructure, including affordable housing, which has been indicated as a top priority for the bank.”

The OCC remains committed to working collaboratively with the government and its members to advocate for policies that bolster the province’s economic health and ensure a prosperous future for Ontario.

The Peterborough and the Kawarthas Chamber of Commerce is an active and engaged member of the Ontario Chamber of Commerce.

Content provided by the Peterborough and the Kawarthas Chamber of Commerce.

Engage with us on social media on Twitter, Instagram, Facebook and Tiktok. Write to us at tips@ptbocanada.com. Sign up for PTBOBuzz newsletter here.

Voice of Business: Quality Data Takes Local Input

/Data is worth more than $100 billion globally, a figure that is quickly increasing.

That’s just the value of what we can directly monetize. Its value goes well beyond that, playing a critical role in life and business. We use data for everything from picking television shows to planning growth in our communities.

Good quality data can be priceless. The more detailed and the more local the information, the greater its impact. At the Chamber, we rely heavily on data to better understand business and economic challenges and create forward-thinking policy that will better position our business community for the future.

One way you can help is by completing the Ontario Chamber of Commerce (OCC) Business Confidence Survey. This annual survey of businesses across Ontario offers a benchmark on the business climate. It’s your opportunity to have your voice heard on the issues that matter most, including priorities for economic growth, labour shortages, technology, climate change, and confidence in the economy and your own organization’s success.

Data from the Business Confidence Survey is used in the OCC’s annual Ontario Economic Report and its advocacy on policy priorities for the year ahead. As well, chambers, boards of trade, and other organizations use that data to inform their understanding of the challenges and opportunities facing businesses.

The more local participation we have in the survey the more local the data we access. Otherwise, we are relying on data aggregated from across Ontario. Please take five minutes and complete the Business Confidence Survey here. The deadline for submissions is Nov. 21.

Nearly two years ago, the Canadian Chamber of Commerce (CCC) launched its quest to democratize data with the Business Data Lab (BDL). The BDL brings together the latest data from various sources to track evolving market conditions in user-friendly modules. It’s a powerful tool that makes accessing current data and analysis easy for businesses and organizations — and it’s free!

Last week, the CCC announced an expansion of the BDL Business Conditions Terminal. This tool offers up-to-date and historical data on:

Sentiment and outlook

Workforce

Business activity

Business dynamics

Financial conditions

Transportation and tourism

International trade

Environmental practices