For the first half of the year, the economy grew at a rate of 3.3 per cent, but slowed to 0.1 per cent between June and July. A big part of this has been the Bank of Canada’s plan to tackle huge increases in the price of homes and overall inflation by hiking overnight interest rates from 0.25 per cent to 3.25 per cent.

While the overall purchase price of a home locally may still be out of reach for many first-time buyers, there’s no question the market has cooled. The Peterborough and the Kawarthas Association of Realtors reported the average home price in August dropped to $689,437, down from its peak of $885,153 back in February.

According to the Business Development Bank of Canada (BDC), the job market has cooled off as well with Canada losing 113,500 jobs over the last three months. This is partly due to the imbalance between the supply and demand of workers. Unemployment increased from a record low 4.9 per cent to a still historically low 5.4 per cent. But it’s still estimated that there are more than 1 million job vacancies right now.

While there are fewer jobs out there for workers, so far it hasn’t eased hiring woes by any significant degree. With that, the trend toward higher wages is expected to continue along with inflation.

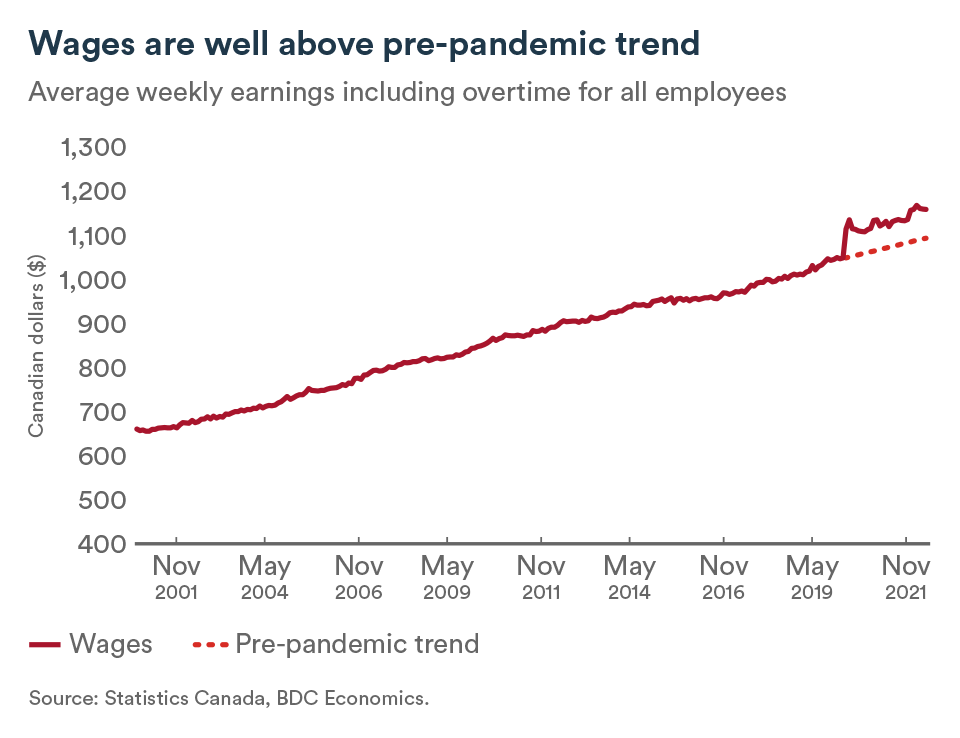

As noted by BDC, “The scale that wage increases have taken in 2022 is significant. Hourly wages have increased on average by 4.0% year-to-date, compared to the historical pre-pandemic average of 2.7% growth. Moreover, in August 2022, wage growth was 5.4% year-over-year. This is the largest annual change in the last 20 years outside of the pandemic period.”

According to Statistics Canada, 64 per cent of businesses have boosted wages for current staff and 46 per cent say they have increased salary offers for new hires.

While a slowing economy is expected to eventually bring wage increases back down, BDC notes the demands of an aging workforce will add further pressure as we struggle to replace retirements.

Another key driver of inflation has been the price of fuel. Oil prices have been dropping since July to the point that the price at the pump is back to the level it was before the war in Ukraine. A few months ago we were paying more than $2 per litre, but now that has dropped to under $1.40.

It’s not just easing the cost of life for people, but it’s having an effect on supply chains. From trucks to mining to agriculture — the drop in fuel prices should filter down through lower input and transportation costs to lower prices of goods.

According to BDC, the main factors still causing uncertainty for fuel prices are further fallout from the war in Ukraine and the prospect that OPEC and its allies are looking to cut oil production to keep prices up.

Cooling off inflation will hold back the overall economy. The big question is whether we can manage what the Bank of Canada calls a ‘soft landing’ or whether the economy will begin to decline and enter a recession. If we enter a recession, it will likely be part of a global event as governments around the world have implemented similar strategies.

Making it easier for people to afford the cost of living and for businesses to be able to hire will have other economic consequences. What’s critical for the success of businesses is planning for the storms ahead as we continue dealing with unprecedented challenges.